Byju's, once the hottest startup in the Indian market, founded in 2015 by Byju Raveendran, was a revolutionary force in the education market, reaching a valuation of over 20 billion dollars in October 2022. However, it is now a shadow of its former self. With the mission of educating students through interactive methods like videos and personalized lesson plans, Byju's aimed to revolutionize education. But what went wrong?

In 2016, Byju's witnessed significant popularity, boasting over 5.5 million downloads of its app and attracting more than 200 thousand paid subscribers. The momentum continued, with over 2.5 million paid users in 2019 and a staggering 5 million paid users in 2021, along with an impressive 81 million registered users.

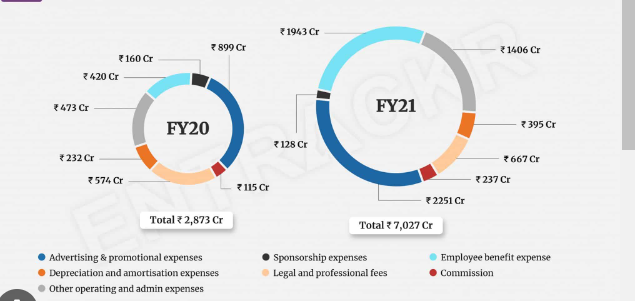

The chart indicates a substantial increase in losses for Byju's from 2020 to 2021.

Witnessing the growth of Byju's, the managers spared no expense when it came to marketing. From sponsoring the World Cup to enlisting the most famous actor in India as its brand ambassador, Byju's spent excessively on marketing.

Total expenses amounted to 7000 crores in the year 2021, with revenue just over 2400 crores, with a significant portion of its funds allocated to marketing.

Sales Practise

Byju's marketing practices have garnered attention for their intensity. According to some reports, employees were fired if they fail to meet sales goals and resorted to scare tactics with parents, instilling worries about their kids' future without Byju's. The company also promoted the purchase of expensive courses that cost over lakhs of rupees, which can be financially challenging for many Indian families. Consequently, this led to parents taking out loans, and some individuals felt they were not fully informed about the loan terms they were signing up for. Byju's facilitated these loans through third-party loan providers in India where it is very hard to get a loan wihtout collateral.

Byjus aggresive sales practise

Accounting problems

- Byju's sells multi-year courses: These courses span over multiple years, but students pay the full price upfront.

- Traditional accounting: Normally, companies wouldn't recognize the entire revenue upfront. Instead, they'd spread it out over the duration of the course. This makes the financials better reflect the actual flow of money and services.

- Byju's approach: In contrast, Byju's reportedly recognized the full cost of the course as revenue in the year it was bought. This made their financial statements look much better in the short term, with higher reported revenue.

However, this approach can be misleading because it doesn't accurately reflect the real situation:

- Revenue isn't earned yet: Byju's hasn't actually delivered the complete service in the first year. They still have to provide the course for several years to come.

- Risk of future refunds: If students drop out or get dissatisfied, Byju's might have to refund part of the money. This wouldn't be reflected in their initial inflated revenue numbers.

- revenue recognition

Byju's , made several high-profile acquisitions in recent years, including WhiteHat Jr for $300 million and Aakash Educational Services for nearly $1 billion. However, these acquisitions haven't all been smooth sailing.

Challenges:

- Financial strain: Some acquired companies weren't profitable, adding to Byju's own financial losses. This put pressure on their resources and overall financial health.

- Difficulties in scaling: Growing quickly through acquisitions can be tricky. Integrating different companies and maintaining quality across a larger organization can be complex.

- Negative perception: Byju's faced criticism for its marketing practices and pricing. This eroded trust and made it harder to attract new students.

Consequences:

- Reduced valuation: Byju's market value has dropped significantly, from over $22 billion to less than $3 billion.

Comments

Post a Comment